The Blockchain Debate Podcast

The Blockchain Debate Podcast

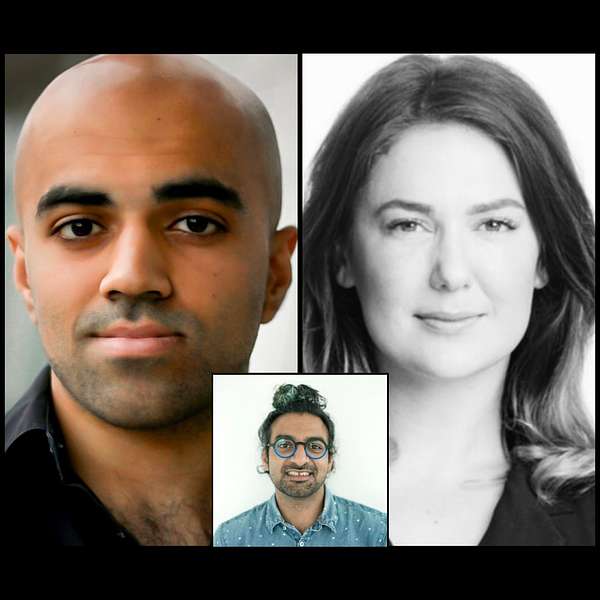

Motion: Yield Farming is an innovation (Haseeb Qureshi vs. Meltem Demirors, co-host: Tarun Chitra)

Guests:

Haseeb Qureshi (@hosseeb)

Meltem Demirors (@melt_dem)

Host:

Richard Yan (@gentso09)

Tarun Chitra (@tarunchitra, special co-host)

Today’s motion is “Yield farming is an innovation.”

Yield farming, or liquidity mining, refers to a newly popularized practice of DeFi protocols, where the protocols incentivize usage with reward tokens. The trend was kickstarted with Compound offering their native tokens for anyone lending on their platforms. And with the mooning of COMP, many other DeFi projects followed suit with their own liquidity mining schemes. This led to soaring prices, unprecedented volumes, popularization of ERC20 friendly DEXes such as Uniswap, proliferation of nonsensical meme coins, and all the elements of another hype-driven bull run.

The question is, is yield farming innovation? That is, is this something fundamentally different from what we’ve seen before? A better understanding of the utility of this mechanism will inform assessment of its sustainability.

Today’s two debaters are investors of high profile funds that actively partake in the yield farming ecosystem. And our co-host is a repeat guest with unique perspectives on the topic at hand.

Today’s episode is shorter than usual, due to speaker time constraints. And there are a few threads in the conversation that certainly could’ve used a deeper dive. Alas, maybe we will cover those areas in a future episode!

If you would like to debate or want to nominate someone, please DM me at @blockdebate on Twitter.

Please note that nothing in our podcast should be construed as financial advice.

Source of select items discussed in the debate:

- Yield farming explained: https://www.coindesk.com/defi-yield-farming-comp-token-explained

- Haseeb's research pieces at Dragonfly: https://medium.com/dragonfly-research

- Meltem: https://www.meltemdemirors.com/

- Haseeb discusses decentralized trading on Unchained Podcast: https://unchainedpodcast.com/why-decentralized-trading-has-10xed-in-a-few-months/

Debater bios:

Haseeb is a managing partner at Dragonfly Capital, a cryptocurrency venture fund. Before this role, he was a General Partner at another crypto fund named Metastable Capital. He is also a crypto educator and has published a comprehensive blockchain course on nakamoto.com. He previously developed software for Earn.com and Airbnb. Prior to his journey in tech and crypto, he was a Full Tilt Poker sponsored professional poker player, and he conveyed his learnings in the book: The Philosophy of Poker. Haseeb subscribes to the philosophy of Effective Altruism, where one undertakes a high paying career to donate his earned money to charity.

Meltem Demirors is Chief Strategy Officer of CoinShares, a digital asset investment firm. Previously, Meltem helped build and grow Digital Currency Group, also a crypto fund. Prior to crypto, Meltem worked in the Oil & Gas industry in trading, corporate treasury, and M&A roles. She is also a founding member of the World Economic Forum Blockchain Council and testified before the House Financial Services Committee on digital currencies. Meltem teaches at her alma mater MIT as well as Oxford, and is passionate about privacy and civil rights.

Tarun Chitra is Founder and CEO of Gauntlet, a simulation platform for crypto networks to help developers understand how decisions about security, governance, and consensus mechanisms are likely to affect network activity and asset value. He previously worked in high frequency trading for Vatic Labs and was a scientific programmer at D.E. Shaw Research.

The Blockchain Debate Podcast - Yield Farming

Richard: [00:00:08] Welcome to another episode of The Blockchain Debate Podcast, where consensus is optional, but proof of thought is required. I'm your host, Richard Yan. Today's motion is: Yield farming is an innovation. Yield farming, or liquidity mining, refers to a newly popularized practice of DeFi protocols, where the protocols incentivize usage with reward tokens. The trend was kickstarted with Compound offering their native tokens for anyone lending on their platforms.

[00:00:36] And with the mooning of COMP, many other defy projects, followed suit with their own liquidity mining schemes. This led to soaring prices, unprecedented volumes, popularization of ERC-20 friendly DEXes, such as Uniswap, proliferation of nonsensical meme coins, and all the elements of another hype-driven bull run. The question is, is yield farming innovation? That is, is this something fundamentally different from what we've seen before? A better understanding of the utility of this mechanism will inform assessment of its sustainability.

[00:01:12] Today's two debaters are investors of high profile funds that actively partake in the yield farming ecosystem. And our cohost is a repeat guest with unique perspectives on the topic at hand. Today's episode is shorter than usual, due to speak or time constraints. And there are a few threads in the conversation that certainly could have used a deeper dive. Maybe we will cover those areas in a future episode.

[00:01:37] If you are into crypto and liked to hear two sides of the story, be sure to also check out our previous episodes. We feature some of the best known thinkers in the crypto space.

[00:01:47]If you would like to debate or want to nominate someone, please DM me @blockdebate on Twitter. Please note that nothing in our podcast should be construed as financial advice. I hope you enjoy listening to this debate. Let's dive right in.

[00:02:06] Welcome to the debate. Consensus optional, proof of thought required. I'm your host, Richard Yan. Today's motion: yield farming is an innovation. To my metaphorical left is Haseeb Qureshi, arguing for the motion. He agrees that yield farming is an innovation.

[00:02:24]To my metaphorical right is Meltem Demirors, arguing against the motion. She disagrees that yield farming is an innovation. To my metaphorical middle, is Tarun Chitra, our special co-host today.

[00:02:38] Here's bio for the debaters and the cohost: Haseeb is a managing partner at Dragonfly capital, a cryptocurrency venture fund. Before this role, he was a general partner at another crypto fund named Metastable capital. He is also a crypto educator and has published a comprehensive blockchain course on nakamoto.com. He previously developed software for earn.com and Airbnb. Prior to his journey in tech and crypto, he was a Full Tilt Poker sponsored professional poker player, and he conveyed his learnings in the book The Philosophy of Poker. Haseeb subscribes to the philosophy of effective altruism, where one undertakes a high paying career to donate his earned money to charity.

[00:03:23] Meltem Demirors is Chief Strategy Officer of CoinShares, a digital asset investment firm. Previously Meltem helped build and grow Digital Currency Group, also a crypto fund. Prior to crypto, Meltem worked in the Oil and Gas industry in trading, corporate treasury and M&A roles. She is also a founding member of the World Economic Forum blockchain council, and testified before the house financial services committee on digital currencies. Meltem teaches at her alma mater MIT as well as Oxford, and is passionate about privacy and civil rights.

[00:04:00] Tarun Chitra is founder and CEO of Gauntlet, a simulation platform for crypto networks to help developers understand how decisions about security, governance and consensus mechanisms are likely to affect network activity and asset value. He previously worked in high frequency trading for Vatic Labs, and was a scientific programmer at DE Shaw research.

[00:04:25] We normally have three rounds, opening statements, host questions and audience questions. Currently our Twitter poll shows that 45% agree with the motion and 35% disagree with emotion. After the release of this recording, we will also have a post-debate pole. Between the two posts, the debater with a bigger change in percentage of votes in his or her favor wins the debate.

[00:04:50] Tarun, please go ahead and let our guests give their opening statements.

[00:04:55] Tarun: [00:04:55] Sure. Given that the question for this debate is focused on whether yield farming is innovative or whether it's a rehash of existing financial, engineering. One question that's quite important to consider is why does farming exist? And much of the discussion about farming has been around the increasing token distribution with the aim of making, token ecosystem more sustainable, unlike the 2017 ecosystems, which are super concentrated.

[00:05:29] But this brings a more fundamental question. What is a sustainable ecosystem and what are examples of successes or failures of such ecosystems that are important to you, that you can use to help the audience anchor themselves to what your beliefs are.

[00:05:44]Richard: [00:05:44] Okay. And with that said, let's have the opening statements starting with Haseeb.

[00:05:49]Haseeb: [00:05:49] So in order to ground this debate, we should start with some definitions. And so I think, I'd imagine that you're tuning in, you probably know what yield farming is. Otherwise, I don't know why you'd be listening, but for those who are unaware, yield farming is the notion of basically rewarding early of liquidity in a protocol with the native token of that protocol.

[00:06:11] So if somebody, for example, one of the simplest examples is let's say somebody is putting up some assets to be lent, in Compound, Liquidity farming or liquidity mining or yield farming is the notion of based on how many assets that person has locked in the protocol. They receive some kind of protocol reward in the native token of Compound, which in its case is comp.

[00:06:31] And so this has blossomed into this huge revolution where now many protocols are adding this notion of yield farming, rewarding, a protocol early protocol adopters with native tokens, as a new distribution mechanism, marketing mechanism, and incentive mechanism to try to get the flywheel of adoption going.

[00:06:50] So the question at hand is this innovation or not? So my answer to this is, I think, if you look from a distance yield farming and all the craze that going on right now, it might look like just that hi flavor of the day that maybe yield farming is the new ICO or IEO or something along those lines.

[00:07:09] But I think yield farming actually spells something different. Yield farming is an innovation, both in capital formation and in the marketing and distribution mechanisms for tokens. And I think it's important to understand why they're different than what came before. So whenever I try to understand what's going on in crypto, I try to analogize it to things that you could've done without crypto, no tokens, no blockchains.

[00:07:33]What is the isomorphism between what we're seeing here and what somebody could have done in the real world with a regular brick and mortar company. as an example, let's, it takes something like let's take something like Compound, right. Compound is probably the easiest one to analyze since it was the first and one of the most vanilla.

[00:07:48]It gives out native protocol, tokens to people who are, participating in the lending protocol by borrowing assets or lending assets. In a sense, what does yield farming look like if it were a traditional company doing this? imagine that.

[00:08:00] Imagine the Compound were another two sided marketplace. So I like to imagine something like Uber or Lyft, basically what Compound's yield farming is doing, is it's basically distributing equity be in the protocols. Do you know the native token? the thing that gives you the right to cash flows that the, protocol generates, it's giving out the equity to early adopters of the protocol. Now in a normal startup, in the real Uber or the real Lyft, what actually happens is that.

[00:08:26] Today, the company will sell their equity to investors for cash. And they'll use that cash to acquire early users by marketing or subsidizing rates or whatever to try to gain market share. So there's this chain of, equity to investors for cash and then cash to users. Yield farming skips a step. Yield farming says, instead of selling this equity to investors, I'll just give the equity directly to users.

[00:08:50] And if the users want to get cash, they can sell the equity and get cash. But if they want to hold the equity, they can get the equity. And it turns out that kind of works. It turns out users love getting equity and it makes them longterm incentivized to make your products succeed, because if you succeed, so do they. And so instead of having to have a referral program and figuring out like exactly how to get your early users to want to proselytize you to their friends and how to get the viral coefficient and all this stuff that normal venture capitalists think about. Or normal entrepreneurs think about.

[00:09:18] Yield farming gives you a lot of that for free. You get this automatic, like virality, because if your users have your equity, then they're incentivized you, all of the things that normally you would need a referral program to do, or that normally your VCs would be incentivized to do because they're incentivize with your equity, they get the upside, if other people are excited and participating in your protocol. So it's the same model that made Bitcoin and other cryptocurrency succeed. Except of course, with many of these yield farming, native tokens, they also come with the ability to engage in governance.

[00:09:48] And so, there was a recent blog post that I really appreciated about this notion of exit to community. That's what yield farming allows. It allows this ability to exit to community. And to me, I see this as an innovation in capital formation. And to some degree, we've seen examples of companies that have wanted to do this before.

[00:10:06]I remember, I used to be at Airbnb. And Airbnb had this notion that they wanted to distribute equity to hosts on the platform. Uber also had the same idea. They wanted to distribute equity to drivers on the platform, but they weren't allowed to. And the other side of it is it's not just an innovation and capital formation, but it's also an innovation in token distribution and marketing, because, before yield farming existed, if you want it to distribute a token to your users, You didn't have a lot of great options, right?

[00:10:31]Early in 2017, people were basically, they were cuing off Bitcoin. It's okay, we'll let mining be the way that we distribute our token. But of course today, mining is not that decentralized. So having your coin be mined basically means you're distributing it to professionalize miners with mining farms in China.

[00:10:47]And that's not a great way to distribute your token very widely. Selling your token in an ICO doesn't work that great. IEOs aren't so hot. So beyond selling to investors and then getting your token listed on exchange and selling it to retail. If you really want to distribute your token widely to your most excited and rabid users, what are your options?

[00:11:05] Liquidity mining has become, I think, today, the dominant way to distribute these tokens effectively to your users. Now this is liquidity mining of shortfalls. Absolutely. So does everything that has come before it. Liquidity mining is an evolution when I think of trade mining, which sort of began and fell with F coin.

[00:11:21]So there's a lot of tweak, there's a lot of tweaking to do and getting the incentives. And I think, many people have written about this, like Tushar at Multicoin and then many people have analyzed the, what exactly are the right knobs to be tweaking and getting the distribution and the incentives right on the liquidity mining / yield farming.

[00:11:37] But I think liquidity mining is different. It's innovation and it's not going to be going away.

[00:11:43] Richard: [00:11:43] Thanks Haseeb, please go ahead Meltem.

[00:11:46] Meltem: [00:11:46] Okay. Great. So to me, yield farming is not innovation and I'm going to lay out my thought process. So I want to first start with idea of innovation because I think, much of this debate as with any debate comes down to semantics and what we're actually talking about. I think in a lot of the pre debate discussion, there's conflation of the broader trend of DeFi or open finance with yield farming.

[00:12:11] So I want to separate that topic. so let's talk about innovation for a moment. So innovation in capital markets is really the core of my investment thesis and what we're building at my firm. I'm an innovation capital markets, really hard to gauge. Let's just start maybe by discussing who the participants in capital, which traditionally are and what their objectives are.

[00:12:31] So if you're trader, if you're someone who's managing a pool of capital, you're going to have a number of different priorities. When I worked in corporate treasury for the largest corporation in the world, which at the time was ExxonMobil, we had a number of different goals with the assets we held in our balance sheet.

[00:12:45] But primarily what you're trying to do is optimize the opportunity cost of capital. Meaning, if I hold a bunch of assets, what is the best opportunity for me to, number one, preserve my principal, meaning the value of my assets, and number two, optimize for growth. And so most people who are operating capital markets are making different trade offs between risk and reward to try to optimize around the opportunity cost of capital.

[00:13:13] And I think as Haseeb articulated, there's a number of different ways that you can create a value out of capital. You can launch new products, you can launch new services, grow top line revenue. You can optimize the way you manage existing assets on your balance sheet. And I think what yield farming is that its core is effectively permutation of income investing and at worst a pyramid scheme.

[00:13:34] That's fine. I'm not making judgements here. I'm just describing what I think these things are. So let's just dive into yield farming. What it actually is. It's someone who's fundamentally long Ethereum or Ethereum based ERC 20 assets. So that's an important distinction. I think step one is in order to participate in yield farming, you already have to be fundamentally long.

[00:13:55] So while I love this argument that we're democratizing access, et cetera, all [inaudible] to why this is just Cantillon effect, in a different form. But basically you have people who are fundamentally long assets. In this instance, it's, they're an ERC 20 based assets and they are earning interest, for leveraging those assets to the protocol.

[00:14:14] And the way they're earning interest here is in the form of a new token. And the argument here is okay, if the tokens are worth money, right? Which many of these are, or at least they are, when they initially launched, then you can start to bank with them and do other things that look a lot like banking and you can lock them up in other protocols.

[00:14:31] And so you get this whole ecosystem that gets built around these tokens, and that sort of gives you sway to the idea of decentralized finance. But much of what yield farming is aiming to do, which Haseeb alluded to in his argument is that yield farming is really replicating one of the oldest tricks in the crypto book.

[00:14:48] They're incentivizing behavior to increase the utility and value of a network via native token reward. And it's really just a different permutation. It was the premise of many ICOs, and it really can be applied to any application that benefits from network effects, whether it's the multiplayer game, whether it's financial market, there it's a social network, whether it's a marketplace.

[00:15:08]All of these things effectively in my view at the end of the day will become financialized will become some form of financial market and really this idea of yield farming. It's taking users in a small closed system and drawing in capital and labor to allow them to create more value. And what people are doing in the device space is they're layering these systems on top of one another.

[00:15:31] So what they're effectively doing is creating a token that has no inherent value. Has zero real value, which most assets, have no quote unquote real utility value. But what they're doing is they're giving out these tokens. some of them may have an income component. Some of them may have a governance factor, but they're incentivizing people to hold these tokens and prevent them from dumping them on the market.

[00:15:55]By allowing them to put these new tokens into another sort of lock up, to create more yield for another crop and so on and so forth. And as happened in that famous Feyman lecture where a woman said, Hey, the world's not round. The world is actually flat. It's a plate on the back of a turtle. He said, yeah, what's the turtle riding on. She said, it's turtles all the way down here. I think what we have is tokens all the way down.

[00:16:20] So I want to quickly talk about one more topic, which I think is relevant to the discussion I want to have today. The theme of DeFi and certainly the yield farming feels new, and I think an interesting way to gauge how people are engaging with him, particularly traders are engaging with it is to look at two things.

[00:16:37] Number one is sentiment. And number two is positioning. So sentiment is what I say. It's what I say I feel and positioning is what I do. And so a lot of times, sentiment and positioning can be two very different things. I think from a market's perspective, it's important to talk about. So if we look at sentiment, if you peruse crypto Twitter, telegram chat rooms, the sentiment on yield farming is extremely bullish.

[00:17:02] But if we look at positioning, the market doesn't necessarily reflect this. Sentiment people are really quickly moving from farm to farm, to farm new yields, but they're also moving really quickly to dump earned tokens on the market. Because in fact, the sentiment for many of these new yield farms is in fact, very bearish.

[00:17:21] There are very few tokens that have escaped this trap of bearishness and that have done well at creating quote unquote illiquidity black hole, which I will borrow from the Thor Chain white paper. And those are the ones that have arbitrarily implemented a token cap like [inaudible], thus creating FOMO amongst holders and market participants were confusing scarcity for value.

[00:17:41] Now, why does this happen? Traders are rational. People are rational. The incentives are logical. If we look at the behavior of traders, what they realize is this innovation is really a good old fashioned pyramid scheme in disguise. And so the goal for most yield farms is to maximize profit by extracting as much value as possible, as quickly as possible for the pyramid collapses. Look at spaghetti. Look at yams, look at hot dogs. Okay. Name your favorite food here.

[00:18:08] What I want to talk about last is the opportunity cost. so the opportunity costs. Question's an interesting one. If I'm already fundamentally long ether and other ERC 20 tokens, I could either deposit them on a yield bearing protocol or deposit them with a more traditional CeFi or centralized finance lender and earn 6 to 8% yield.

[00:18:31] Instead, I now have an opportunity to punt my long positions into much higher yield opportunities, actually taking a lot more risks, but for most traders right now, because the value of the underlying assets have been rising and some cases, exponentially, many people and traders are willing to take hunt at the opportunity.

[00:18:50] And yeah, so what I think is really happening here is people who are already inherently long who've created wealth or value. Through being long, these assets are taking the opportunity to further enrich themselves by being first to farm new yield opportunities. That's benefiting through a crypto equivalent of the Cantillon effect, which we've talked about a lot.

[00:19:11] If you're close to the money printer, if you have a vote in how the money printer runs, obviously, you're going to take a punt on enriching yourself, through extracting more value from that money printer.

[00:19:22] So I'll just close with one final statement. Cause it's important to say I'm of the opinion that DeFi's a good thing. We're investing in it. We're excited about it. And even though it's really broad and it's a topic and a new area with a lot of surface area, I don't really think that the yield farming opportunity today is new or innovative. I don't think it's sustainable. And most importantly, I think we need to find models that enrich not only people who are already fundamentally long, these assets, but it needs to actually be distributed in nature.

[00:19:54] And that's the challenge we've had in crypto from day one. And I think these many different permutations we've seen. So I'll pause there.

[00:20:02]Richard: [00:20:02] Great. So obviously a lot to unpack there. So let's move into round two, where everyone will get a chance to respond to each other's points. But I think one thing that was interesting from what Meltem was saying was the basic nature of yield farming. And I think one way I think about it is yield farming is a bit like a bounty based airdrop, where one earns tokens by engaging with the protocol. In many cases, such engagement is depositing to a pool of funds. So Haseeb, do you agree with this analogy with an airdrop bounty? And if so, why do you consider this an innovation? And feel free to respond to the other points Meltem mentioned in her opening as well.

[00:20:49] Haseeb: [00:20:49] Yeah, so I think that's directionally correct. I'd say it's essentially distributing a form of equity to early users / adopters of a protocol. And in a way, if you think of, there's some permutations of exactly how you would analogize this depending on what type of protocol is doing yield farming and what the token represents.

[00:21:07]So for example, with COMP, Compound, COMP token is the implicitly, not literally, but it implicitly the equity in Compound protocol. And so the only equity holders of Compound protocol will be the COMP holders for something like Uniswap or Sushi swap the equity is split between LPs and token holders.

[00:21:22] And so it's little bit more complicated cause it's essentially redistributed from early LPs to late LPs. And there's some different mechanics there, but at a high level, that's basically correct. And I think, I don't think Meltem would actually disagree with that characterization of yield farming. I think what I heard from her is that she feels that yield farming is a permutation on what's come before, which.

[00:21:45] I agree. I think, you'll talk to, and came out almost explicitly from the original innovation of, trade mining, which started with Fcoin and several other exchanges, did the same thing. and it culminated in what has now was kicked off by Compound as yield farming.

[00:22:00]But in a relatively more sustainable way that hasn't led to the same mechanics as what happened with that point. Now that said, so the first thing I dispute is whether or not a permutation is innovation. I think permutation is innovation. I wouldn't say that yield farming is invention in the sense that there's no possible analog for this thing, but I think that's what innovation is.

[00:22:18] Innovation is permuting on, what's already there to find better and new, different ways of doing things. And I'd say, I don't think anybody here could seriously dispute that yield farming is different. That it's a different way of doing things now that said, Melton is quick to point out that a lot of what's going on is very speculative.

[00:22:35] It's highly leveraged. There's a lot of bull going on in this market. And I a hundred percent agree with that. that said, I don't think calling the. The, all the things going on with based and ample and blah, blah, blah, pointing out that all of this is extremely speculative and not likely to result in longterm value, isn't really an argument against it being innovative because, I would say that both Bitcoin and ERC-20s in general have been tremendously innovative and they've also been the subject of many speculative bubbles. And it probably won't be the last one. So this is crypto. Pretty much anything new and exciting and crypto triggers some kind of speculative bubble.

[00:23:11] But I think the underlying mechanics here are very real. And to the extent, go ahead.

[00:23:17] Meltem: [00:23:17] I want to respond to that. So I think you said something that I fundamentally disagree with, and you said that these tokens, that people are mining are representative of a new form of equity. And I fundamentally disagree with that. And I actually think the reason I think yield farming's not innovative is what we're doing is we're taking assets people already own.

[00:23:35] So we are helping people who have already reaped the benefits of ICOs, IEOs, trade-mining, all these permutations that have come before, who were here early. They are the ones who are benefiting most from yield farming. And so to the extent that we're talking about building new models to organize the firm, right, really at its core, I think it always excited me about cryptocurrencies and the idea of networks that have token incentives is this idea of reconceptualizing the theory of the firm.

[00:24:03]And really in the theory of the firm, there are two factors. You have capital and you have the labor, right? In equity focused startups, a lot of times people are able to earn equity by either providing labor or providing capital. In the yield farming world, the people who earn yield are the people who provide capital, there's no labor involved because if you don't have capital, you can't participate in yield farming. And in fact, given the fees associated with the Ethereum network and just given the, like low yields on many of these things, it's really important for you to have a large bag to leverage.

[00:24:38] And so I think to me, what would be interesting is if we had models for more distributive economics, where we could actually have new models for organizing, but to me, this is insider's continuing to play insider baseball, enrich themselves before anyone else can participate. So that to me has seen as the fundamental disagreement is I don't think these new things are representative of equity in fact, at all, equity comes with rights and covenants and the like, and these things don't come with any of that.

[00:25:06]Haseeb: [00:25:06] Okay. Okay. I think that's a very good point. And I want to, I wanna address that head-on, which is that it sounds like, you are judging a yield farming on the basis of its ability to be truly redistributive and rewarding of everybody who drives equivalent value to the protocol. So like you mentioned, there are two elements of making any protocol or project work, which are labor and capital. And at the moment, yield farming really only rewards capital. And I completely agree with that. I think that is a hundred percent correct.

[00:25:35] Now that said, I don't think yield farming is right for every protocol. There are some protocols whose principal success is determined by the amount of capital that's in the protocol to begin with right now, we might be wrong in assuming that this is correct, but this was the working theory behind Uniswap, these different AMMs that the more liquidity they have, the bigger moat they have and thus, the more successful they're likely to become.

[00:25:57] Same theory was true of Compound. There are other that believe the same thing. Now they may or may not be correct. But they do believe that, hey, we are right now in a land grab moment, we are trying to get as much capital as we can under our roof. And once we do that, we'll get this large flywheel, we'll get this network effect.

[00:26:13] And then we will be in Superbowl compared to any other new protocol on the block, right? The same fundamental dynamic behind Uber and Lyft, burning through cash to try to gain market share so they could dominate the market. Now you're right. That yield farming does not address one. it doesn't necessarily say that this is going to be distributed in any egalitarian way.

[00:26:33]People may have thought that at a certain point, but I think it's a naive assumption that yield farm is going to result in some kind of egalitarian distribution of capital in who's mining. Because of course there are very large players who have lots of money who are willing to mine this stuff.

[00:26:45]Now look at something like Compound. I think Compound is a good example of this, right? You mentioned very correctly that there are very large firms, hedge funds, market-making firms that are mining comp, getting tons of it, and then to selling it right to the extent that these guys are not longterm players in the Compound protocol, they are in some sense they are one they're still providing work to the protocol by actually putting in capital and doing this thing that looked Compound may be wrong in their belief.

[00:27:12] But their belief is that if we gain enough assets under management, in the protocol, we are going to be the winner and then the longterm spoils are going to pay for themselves. And then second, of course, if these people are going around and selling this token on the market, it's being purchased by people who do believe in them long term potential, a potential of Compound.

[00:27:28] And at the moment...

[00:27:30] Meltem: [00:27:30] to make money and believe that other people will also ...

[00:27:33] Haseeb: [00:27:33] Of course,

[00:27:33] Meltem: [00:27:33] In there for, by ...

[00:27:34]Haseeb: [00:27:34] People only buy anything because they want to make money. That goes without saying, the longterm, there's no sink for Compound at the moment. There's no, you can't lock it up. You can't do anything with it at the moment until, other than just participate in governance.

[00:27:45] So to that extent...

[00:27:46] Meltem: [00:27:46] I can take my Compound and I can farm Sushi with it. I can farm Kimchi with it.

[00:27:50]Haseeb: [00:27:50] Obviously I can't stop another protocol from subsidizing the ownership of this or that token. The question is simply, in isolation, what is the Compound liquidity farming mechanism doing for Compound?

[00:28:02] Long story short, my take is that I agree with you at a high level, that this stuff is primarily being distributed to very large holders, in the beginning who are benefiting from this. But the belief is that's worth it to the protocol. Not every protocol benefits from rewarding, lots and lots of capital in the early days.

[00:28:20] If you want to reward labor. Yield farming is not the right mechanism to reward labor. Look at YFI, right? YFI is finding ways to reward some of the people who are contributing their labor to the protocol, but you have to do that in a different way. Yield farming is not the right mechanism for that. If you overload yield farming, and assume it's going to solve all of your problems, then you've got another thing coming.

[00:28:39] And I think many of these protocols that are, shortsightedly thinking that the only thing they need to do is incentivize capital. I a hundred percent agree with you. I think they are shortsighted in that exact way, but yield farming is a part of, I think, how some protocols that do benefit from the accumulation of capital early on will incentivize that capital to arrive.

[00:28:57]Richard: [00:28:57] By the way Haseeb, just to latch onto something you said earlier about centralized entities, trying to do this yield farming mechanism, such as Uber and Airbnb, and they eventually refrained from doing so out of legal obstacles. Is there a equivalent in the crypto space when it comes to distributing these cryptos, is there a regulatory arbitrage or is there something lurking in the corner about regulatory action that could topple all of this?

[00:29:27] Haseeb: [00:29:27] There's certainly regulatory arbitrage at the bottom of this. And in the sense that, of course, if these tokens are securities, then what is happening in yield farming is obviously not legal, at least, according to the sec. So it's not legal to be distributing to people in the U S that said the working theory for a lot of these are courses that, because these are fair launched because the, everything is being mediated through smart contracts.

[00:29:51] There's relatively little involvement from individuals that, there are distributed multi-sigs, that are controlling a lot of this stuff. Some of these are jokes and s--- shows, but there are, I think some projects that are actually very earnest and thoughtful about how to achieve the right trade off between decentralization and speed.

[00:30:09] And I think, I quote YFI and Compound as being two examples of that.

[00:30:13]Meltem: [00:30:13] But I think the fundamental premise of this argument is not, are they thoughtful? I think the question is, are they innovative? And I think they're, to me, the fundamental function of how people engage in capital markets is to optimize the opportunity cost of capital and to seek, an appropriate amount of risk, commensurate to the word, the reward they expect to receive.

[00:30:35] And I think when you look at yield farming, it's people who are already fundamentally long taking their assets and pursuing opportunities to realize very high reward. In exchange for taking some risks. and so to me that's the fundamental question here again, do I think that, some of the things are meaningful?

[00:30:52] Absolutely. Am I participating in some of them? Absolutely. Do I think there's one role for this in the future of this industry? Absolutely. But do I think that all problems can be solved through yield farming? Absolutely not. Do I believe this is innovative in the sense that it's new to capital markets?

[00:31:05] Absolutely not.

[00:31:06]Richard: [00:31:06] Okay. So I just want to also bring up a different perspective that. See if alluded to in his opening from a marketing perspective, yield farming creates a new meme in crypto, which some say has a similar feel to stacking sets and BTC had to room for mentioning that on a different show, we have your thoughts.

[00:31:26] Meltem on the power of social consensus being created by this yield farming that benefits the ETH ecosystem.

[00:31:34]Meltem: [00:31:34] Yeah. I think this is a great point. whenever we talk about investing in protocols or really just investing generally, I gave a presentation about three years ago at a. Conference, where a lot of ICS were being discussed. And one of the things I mentioned, I think my talk was called how to not be a s---coin.

[00:31:53] And so it feels topical here. yeah, one of the ways we frame the topic is, in any project, there are a number of different forms of capital that you need. You need financial capital, you need, human capital and you need social capital. So when we talk about yield farming in this context, as Haseeb mentioned from a financial capital perspective, indeed yield farming can be a great way to create the financial capital that's needed to help your project to be successful.

[00:32:19] And I think one thing we haven't talked about, is some of the dynamics of these yield farming protocols, where a lot of the people involved in these. Protocols and projects early on, will benefit disproportionately from the distribution of these new tokens that are mined, which allows them to done create, a lot of financial capital.

[00:32:35] And obviously that creates some interesting structures and incentive. This certainly yield farming's useful at creating an aggregating financial capital. The second type of capital you have is human capital. And I think Chainlink is actually really interesting example here, not in the context of yield farming, but the Chainlink team has been around for gosh, about six years, I met them in 2015. And they didn't really have a robust product, but as Chainlink started going up in value, that financial capital enabled them to obtain really great human capital.

[00:33:06] And over the last, six to 12 months as they've aggregated more financial capital, they've been able to accumulate really phenomenal human capital that can then help them build a really, better product and help them. And extend on the original idea they started with.

[00:33:20] And so I think there is a very much relationship between financial capital and human capital. And then the last component, social capital, I think is the hardest to get in the crypto space because it is a very noisy domain, There are thousands of people screaming for attention. And so what I do think is a unique about yield farming is effectively.

[00:33:41]You are forcing people to pay attention to your protocol by offering them the highest final social incentive is. So in a way, you are paying people for their time. And again, I think one of the core challenges of crypto business models and that we haven't seen so many business models flourishing outside of the exchange business model or businesses being in the business of facilitating slow, which even, everything happening in the DeFi space at its core is about celebrating transactions and capturing a fee.

[00:34:07] What I think has been interesting to note is, many internet business models are predicated on this idea of monetizing eyeballs. And the great struggle of internet business models has been, how do you move away from monetizing eyeballs and engaging in surveillance capitalism, and really advertising based capitalism business models and move towards, different business models that maybe aren't so predatory.

[00:34:30] And certainly, that's not the topic of this conversation, but I think social capital, historically has been associated with your ability to spend money on marketing. What yield farming does, is it inverts that relationship where you're actually using the idea of people making loads of money. i.e., crazy APYs and even daily yields, near north of 200, 300, a thousand percent. So what you're doing is you're using this token that you print out of thin air to create a demand for the product and to create social capital, that then drives your ability to create financial capital and human capital.

[00:35:07] So I think again, from a relationship perspective, you certainly can use yield farming and we've seen successful examples of people using yield farming to create a lot of social capital. Now, whether or not that social capital sustained, I think is a larger question. And as Steve already alluded to, I think there are very few projects who've managed to escape this vortex of the constant hunt for yield.

[00:35:29]And so very few projects have been able to successfully sustain any social capital that's been created through the manipulation of financial capital.

[00:35:37]Haseeb: [00:35:37] Boy, that sounded really innovative the way you described it.

[00:35:40]Meltem: [00:35:40] We can argue the semantics, but as I said, it's an inversion of the model. But look, I think at the end of the day, This is about, what behavior are people engaging in? And the behavior people are engaging in is rational behavior that we see in every financial market, if I'm fundamentally long dollars, right?

[00:35:57] And I've had an opportunity to leverage my dollars to make more money, I'm going to engage in that behavior. Look at the stock market, right? Things are trading at 2000 X for PE ratios.

[00:36:07]Richard: [00:36:07] Okay, so Tarun, would you like to jump in with your questions? I'm watching the clock and I'd love to have your questions come in.

[00:36:14]Tarun: [00:36:14] Yeah. So I think one of the interesting things that Meltem pointed out, and Haseeb maybe underweighted was that there's sort of two types of farms. There's the cashflow business farm. So there's COMP, which, has real cash flows coming in. Those reserves, it has an insurance fund to manage. It has real revenue that's comparable to that of say, BlockFi, so that the token actually has some underlying value. And then there's the kth-derivative asset of stake COMP into food coin one, stake food coin one into food coin two, ... And I would say. I'm not sure whether either of you feel this is true, but the fact that you can actually make the kth order derivative in three lines of code is, actually, quite innovative.

[00:37:04]I don't think we've ever seen something that happened that quickly in terms of making derivatives. But one interesting thing is that by stack these stacked, assets are really really complicated, short vol product. They're really hard for the end user to even know what their true risk is.

[00:37:22] And my question is, if you do think that this is innovation, and then my, what happens, if say, people started buying the kth order product, and they don't realize they're not getting the cash flows from the first order product and things blow up. What will be the point at which we reach an equilibrium and is that equilibrium itself innovative?

[00:37:45]Haseeb: [00:37:45] So I'll take a stab at it, but it might be an unsatisfying one is that, the underlying implication that you're making, there is one that I wholeheartedly agree with, which is that, there's a ton of complexity that's being introduced into the system. And I think the, there was an old meme that like, Oh, do you know, DeFi is going to be really solid and secure because it's all transparent and we can see everything that's happening.

[00:38:07] And I think, this DeFi bull run has pretty soundly disproven that idea. I think the incentives of people to take on it as much risk as possible in search of a unsustainably high yields is going to result in some kind of catastrophic unwind at some point. And I think probably all three of us see that fairly clearly.

[00:38:24]That said, I agree with the underlying thrust of your point that something innovative is happening here. It probably will not look in the long run the way it looks today. It's probably not going to be catered to derivatives on top of a protocol token that has some underlying cashflow that's been so far removed from the, the stacked up thing that you have exposure to now.

[00:38:42]But I should know one hallmark of innovation is creative disruption. Like the sign to me that something new is happening is that people are doing all sorts of new things. And most of them are probably going to fail and a few of them are going to succeed. And it was the same story. I worry that we saw in 2017 that there were lots and lots of really stupid ideas.

[00:39:01] Most of which blew up and a few things that have ended up really going the distance and becoming the foundation of this economy that we're talking about today.

[00:39:08]Meltem: [00:39:08] If I can follow on that as well. So I think a lot of people actually over, there's been a lot of cautionary tales and a lot of panicked sort of commentary about Oh, there's going to be a massive DeFi unwind, and it's going to implode and it's going to be terrible. I actually don't know if I believe that's true.

[00:39:26] So I'm willing to be controversial here actually, as I alluded to earlier in my opening statement, I do think that most traders are rational and they're making calculated decisions about risk and reward. And actually a lot of the behavior we've seen in these yield farming protocols with people moving in early, farming the maximum they can, and then dumping their tokens is actually a sign that this unwind will happen. I think a lot of the people who are participating in these yield farming opportunities, particularly of the second flavor that you alluded to Tarun, these kth derivatives, which I actually think are really interesting from capital markets perspective.

[00:40:01]A lot of people participating in those are very aware of what they're participating in. Particularly people who are deploying larger pools of capital because they're fiduciaries, they're in the business of managing risk and reward. So I actually do think that a lot of people who are participating in this market are certainly very aware of what's going on is not sustainable, that the yields that are on offer are likely not sustainable and at some point, it will evolve towards a model where the yields are much more modest.

[00:40:26] We see yield compression all the time in traditional finance, especially in emerging asset classes and emerging lending opportunities. We've seen this in middle-market credit. As these areas we're institutionalized, yields start to compress more quickly because are very good at finding arbitrage, seeking it out and then neutralizing the arbitrage.

[00:40:44] And we've seen those over and over again in crypto, as markets become more efficient is more capital enters the market and as more sophisticated traders on through the market, what I think, maybe I'm getting to, as I'm listening to this conversation, unfold is maybe, yield farming itself isn't the innovation. But what I do think is the innovation is actually the ability of people to create the system of tokens all the way down or turtles all the way down, or this kth derivative as Tarun called it, in this new world. What I do think is really interesting from the way that capital markets get constructed, is historically if I traded an asset, I would be very limited as to the venues that I could trade that asset on. And my ability to have fluidity in my collateral was very limited. And that's long been one of the biggest constraints in global capital markets, right? If I'm a degenerate trader, I'm really limited as to the venues on which I can trade and how I can use my assets, because typically an asset is beholden to the venue on which it trades.

[00:41:41] What I think is actually really interesting here is we're fundamentally breaking the relationship between asset and venue. And so this vision of our ability to trade anything with anyone, anywhere to use it as collateral anywhere, and to basically make assets permissionless, and fully mutable across protocols, opportunities, yield farms, whatever it may be, is the core innovation.

[00:42:03] So this idea that we could take assets and unleash them and allow people to engage in all sorts of degenerate behavior, we may deem degenerate, but I think traders would deem as opportunistic. I do think is exciting. I don't think that yield farming at its core is how that will evolve. I think there's a lot happening, on the derivatives side that's really interesting. And if we look at where the growth in this ecosystem is, I do think it's less on let's print more tokens out of thin air, but I think it's more on the, how do we create different permutations of derivatives and how do we financialize assets that have historically not been able to be financialized because of these constraints we've had in capital markets.

[00:42:41] Haseeb: [00:42:42] Maybe Meltem, you can disentangle for me: how do you distinguish these sort of kth derivatives of a wrapped, Uniswap LP interests that's in Sushi, like how is that distinct from the phenomenon of yield farming?

[00:42:55] Meltem: [00:42:56] I don't think the innovation is being able to take ETH, wrap it, makes Sushi, take Sushi, wrap it with ETH, to make more Sushi to then take Sushi to farm Kimchi, to make Kimchi to wrap with the Sushi and the Kimchi to then make more Kimchi.

[00:43:11] Tarun: [00:43:11] Can I just say one thing, I really hope you let your loved ones listen to this podcast and listen to them, try to interpret that sentence that you just said. I feel like it's actually quite amazing the types of things that people in crypto have been saying in the last few weeks. It just sounds like you sound like a crazy person to a non crypto person, right?

[00:43:34] Meltem: [00:43:34] That's why this industry is so delightful. Isn't that why the four of us are here? I feel like I have these conversations all day, so I've become immune. And by the way, when we were having this conversation in 2014, with the first slew of ICOs that came out, having this conversation in 2015 and 2016 and 2017, I feel every year I've had this conversation, it's just like permutations.

[00:43:56]I remember telling someone about time new bank, which was like an ICO that was going to monetize your time, and now we have this like a yield farming thing called time coin. So I don't, I feel like every cycle, you just do the same thing in a slightly different way.

[00:44:12] But what I think is interesting, right, is this idea that, the only value in our world that we've effectively been able to capture so far is, is the value of things like commodities and equities. And a lot of like more intangible assets have been really difficult to prescribe value, to create markets for it. Like I used to trade carbon, how do you create a market for carbon rates?

[00:44:33] It's like a very esoteric concept. And so you introduce all of these like new sort of parameters in ways to try to. Grapple with this problem, but it's really intractable and intentional. And what I think is interesting here is for the first time we can create markets for intangible things. which to me is exciting from a financial engineering perspective.

[00:44:50] Are they going to be innovation to be seen? I think they're like a lot of wrinkles that need to be sorted out and maybe yield. Farming's an early iteration of that wrinkle. But I think at its core, like, How do we change the roles that different institutions play in capital markets? And is there a way for people to leverage more than just existing capital and existing collateral that is already financialized to create value?

[00:45:13] I think is the question I'm curious about, I don't know if that answers your question Haseeb.

[00:45:17]Haseeb: [00:45:17] Close enough.

[00:45:19]Tarun: [00:45:19] So one actual interesting thing about this idea that you're giving away equity in these protocols as they launch is that, there's something weird about this notion of being able to give away excess yield, using kind of Uniswap LP shares or balancer LP shares, for the reason that you're somehow allowing the end user to be able to hedge their risk of the token that they're earning in the staked asset.

[00:45:52] So I take an LP share. I stake it in this contract. I earn some Sushi, but I can also trade against the Sushi that I'm earning both in the LP share and also on the futures exchange. In some sense, this means that the end user can get equity with no risk and completely hedge themselves. While earning equity. To Meltem's point, this is quite unsustainable.

[00:46:16]But is this an innovation? I don't know if I've ever seen anything quite directly like that. And I know both of you probably have different opinions on this. Do you consider the idea that you can earn equity with zero risk an innovation?

[00:46:29]Haseeb: [00:46:29] It's a very interest point. I think a very prescient one, because I believe that if the yield farming craze continues a whole lot longer, it is going to become increasingly... the players already are somewhat sophisticated, and I think the sophistication level is going to go up to, as you mentioned, lower, the risk that is attendant to actually receiving these protocols subsidies. But of course, that also implies that as the market matures, if the risk is going down to farmers, then that also means that rewards can tentatively, also go down for the same amount of capital. And so in a way, what that really does in a way, making that market more efficient is that if in fact, the principal purpose of yield farming, and you'll find that you could argue there are multiple purposes to it. But if the principal purpose is to gain a moat, if the principal purpose is to gain enough financial capital without having to sell to traditional VCs, in order to make the protocol defensible against comparator and to establish it as a winner in the market, same way that Uber and Lyft and Moviepass and all these other traditional venture backed startups do, if the cost of capital is going down because of the fact that there are now better hedging instruments, all the better.

[00:47:34] It's certainly true that if the protocol subsidy is inflexible such that, as the opportunity cost of that capital goes down, they're unable to modulate the amount of rewards given out. There's some efficient threshold for how much you should be willing to pay for how much financial capital.

[00:47:49] But over time, again, it's early, people are still figuring these things out. Markets are evolving very quickly, as we all know. Once we reach an equilibrium project, we'll have a better understanding of exactly how to turn these knobs, to optimize the amount of capital that they're incentivizing for the amount of rewards that they're giving out and a certain point that really only makes things better now, to an extent it does make it less, it does.

[00:48:13] We can, to some degree, the ability of yield farming to quote unquote reward early adopters, because the point of which you have only professionalized financial capital participating in these yield farming activities. That's going to drive out most of the retail who are looking for really high APRs and aren't going to be getting it anymore because these protocols are going to adapt.

[00:48:31]But that's okay. I think, yeah, again, sort of to an extent, what it's doing is unbundling what VCs offer. VCs right now offer a bundle of several things. We offer help advice, late night phone calls, introductions. And then we also provide capital. And, I'm, I don't want to go too far with this notion, cause I'm not totally on board with the idea that fair launches are the future, and everything's going to fit a launch in the future.

[00:48:55] But I do believe there is going to be more on bundling of venture capitalism. And to the extent that a protocol can now say, hey, VC, I'm going to sell you a little bit of equity because I do want that late night phone calls and the advice and the strategy and whatever. but I don't need a ton of money from you.

[00:49:10] I can actually get that money to build a moat around my company, from my community or from yield farmers or from professional firms that are willing to take the risk at much lower price in a way I think again, that is that's good. That's evolution in capital markets. That's innovation. It's not invention.

[00:49:27] It's not, Einstein general relativity, but innovation to my mind is, ways of making the world more efficient in subtle ways. it's it's financial engineering. And I think this is a perfect example of that.

[00:49:38] Richard: [00:49:38] Thank you, let's move to audience questions. This question is from @stupidcontracts. And his question is how will a possible collapse in DeFi affect Bitcoin? And what about its success?

[00:49:52]Haseeb: [00:49:52] I think it's totally orthogonal to Bitcoin. I don't know why it would affect Bitcoin in any meaningful way. That said, obviously things in crypto tend to be correlated. So if there's some meltdown in DeFi, maybe you would have some knock on effect in Bitcoin, but I don't see any fundamental reason why it would, the amount of Bitcoin that's actually in DeFi is relatively minimal.

[00:50:10] So for the most part, I think DeFi does its own thing. At least that's what we seem to have seen over the last few months.

[00:50:16]Richard: [00:50:16] There's one other question, also from @stupidcontracts: within the category of yield farming, do you separate synthetic assets, AMMs, staking, and insurance? If these are the future, are the protocols today the ones, or is more innovation needed / imminent?

[00:50:32]Haseeb: [00:50:32] That's a great question. I wish I knew the answer to that. I would say that, certainly the protocols today are not going to be the terminal protocols in their current forms. They are going to have to evolve. And there they're very obvious ways in which that's true, such as if 1.0 is going to go the way of the Dodo, in which case, all these things will need to get rewritten for Ethereum 2.0, they're going to be layer-twos. There's going to be questions around interoperability, as we have more and more chains that are connected together. I think it's very clear that none of these things are done. Nothing in crypto is done except maybe Bitcoin.

[00:51:04] And to that extent, basically my answer is that I wish I knew which of these protocols were going to go the distance, if so, I'd push all of my chips into them right now. I have my bets and my beliefs, but it's so impossible to be able to project over 10 years, what's going to happen in this industry that, I think it's a fool's errand to be too confident in that right now.

[00:51:24] Richard: [00:51:24] Thank you, let's move on to the concluding remarks. Let's have Meltem go first, followed by Haseeb.

[00:51:31]Meltem: [00:51:31] I think to start with, let me just start with our original premise of this debate. Look, at the end of the day Haseeb and I, we do the same thing, right? We are investors at our core, and we're looking for opportunities to create these new paradigms. We've invested in similar businesses together. And I think we're both believers in the future of capital markets looking very different than capital markets look today.

[00:51:54] And what I think the crux of what we're arguing is maybe. Even a false argument, because I think we actually do agree on a lot of things. And maybe just disagree at the edges of what the word innovation means. I've always been of the mindset, there really is nothing new under the sun. We as humans, repeat certain cycles of behavior and those cycles get faster and faster.

[00:52:17] And, the tools we have available to us, i.e., the technology that we create maybe allows us to iterate on those cycles in different ways. But at its core, human history, we've repeated the same cycles since the dawn of human time. And I think we'll continue to do it. and so I go back to something I've said for a long time and continue to say, which is there is nothing new under the sun that everything that has been will be again.

[00:52:41] And I feel like with yield farming, we're doing a very similar thing that I've seen in, And the trading world, people who are fundamentally along assets are looking for ways to leverage those assets to generate yield. And if you give me an opportunity to generate a 2000000% APY yield, I'm probably going to take that opportunity.

[00:52:57] So as long as there are 2000000% APY is where the asset I'm getting in return is not completely worthless immediately, I'm going to take that punt. The question to me is a longterm is what we're doing something new. No, I'm not convinced, certainly not given the behavior we're seeing. Does it have the opportunity to create a new paradigm for capital markets? Maybe. That's the hope and aspiration. That's what I'm building towards. But the behavior we're seeing right now is I think certainly doesn't push us in that direction. and so it'll be an interesting question to see what happens when we've seen a big selloff in the market over the last two days.

[00:53:33]Most assets, in the quote unquote yield farming space are down anywhere from 50 to 99% right now. So let's see what comes out of all of this.

[00:53:41]Richard: [00:53:41] Okay. Great, Haseeb?

[00:53:43]Haseeb: [00:53:43] So I think I've made the majority of my points. I don't want to do too much recapitulation here. But I think in summary, I do think yield farming is something new and Meltem made a claim that, there's nothing new under the sun. And generally I tend to agree that most things that we see in crypto have some analog and traditional capital markets and understanding that analogy is very important to understanding what you should expect mechanically to arise here in crypto.

[00:54:09] I'd say the three of us probably agree with that. but I do think actually there are two things I've seen this year. That I feel are genuinely new, that I've never seen before, and that are new from crypto. And I'd say, if we haven't seen anything new from crypto, then what are we doing in this industry?

[00:54:25] And the two things I've seen that are genuinely new, the first is flash loans, which of course wasn't invented this year. But I think really came into the limelight this year with the span of hacks that have gone on. That I think there's no analog for in the traditional world.

[00:54:39] And the second one is Sushi swap. Of this idea that I can in a risk free way, help capital in another project or another business, to coordinate around suddenly flipping just by offering them early rewards. In this thing, I basically can, almost like a bribery attack, do essentially a costless hostile takeover, another, pool of capital that is fundamentally new, nothing like that I have ever seen in traditional markets.

[00:55:08] And it's purely a consequence of the ability within crypto to have much lower cost financial coordination than can be done in the real world because of the fact that everything in this world is programmable. That changes things. It makes things work in different ways that are difficult to predict, from previous examples.

[00:55:26] And look, I just, as much as anybody else try to understand these things through, analogs of what has come before and most of the time things are pretty recognizable permutations on what's come before. But yield farming, I think the biggest sign. Yeah. That it's something new is that it has all of us in this room, reaching for new ways, analogies forms of analysis to understand what the hell is going on here and do something we can find some comfort that, oh, okay. I think I have an idea of what this is. I think I know how people are responding to this thing. And then the next day our models are invalidated, we have to try again. So to me, I think that is the surest sign that indeed this is innovation. It is going to change things. It's probably not going to look this way three years from now. But I think, the way the world looks three years from now will be substantively different and it'll have the echo of what we're seeing here today.

[00:56:17] Richard: [00:56:17] Thanks for your insights. Haseeb and Meltem. So listeners, we would love to hear from you and have you join the debate via Twitter. Definitely vote in the post debate poll. Also feel free to leave your comments. We look forward to seeing you in future episodes of the blockchain debate podcast. Consensus optional, proof of thought required.

[00:56:39]Thanks again to Haseeb and Meltem for coming on the show. To summarize: Haseeb sees liquidity mining as a new way of capital formation and marketing and token distribution mechanism.

[00:56:51] And this new meme has been great for attracting attention and capital for the ecosystem at large, even for coins that aren't directly involved, such as Bitcoin.

[00:57:01] Meltem sees this as essentially the same old story of whales unfairly scooping up fundamentally valueless tokens, and dumping on retail FOMO. And the phenomenon is merely music chair, perhaps with a different song this time.

[00:57:17] What was your takeaway from the debate? Don't forget to vote in our post debate Twitter poll. This will be live for a few days after the release of this episode. And feel free to say hi or post feedback for our show on Twitter.

[00:57:29] If you like the show, don't hesitate to give us five stars on iTunes or wherever you listen to this. And be sure to check out our other episodes with a variety of debate topics: Bitcoin's store of value status, the legitimacy of smart contracts, DeFi, POW versus POS, and so on.

[00:57:47] Thanks for joining us on the debate today. I'm your host Richard Yan. And my Twitter is @gentso09. Our show's Twitter is @blockdebate. See you at our next debate.